Monday, September 12, 2022

Thursday, January 21, 2021

Wednesday, January 13, 2021

Losing weight, saving money, breaking bad habits… At the start of each new year, millions of people vow that January will mark a turning point in their lives.

If you’re also committed to making 2021 your year, consider adding a homeownership goal to your new year’s resolutions.

What do we mean? You could…

💳 Improve your credit score to qualify for the best of historically low mortgage rates

🛠️ Tackle a small home repair to capitalize on an ultra-competitive market and sell for top dollar

🏝️ Quarantine in style and earn a second income with an investment property

With today’s robust market conditions, the time is right to learn how real estate can contribute to your success in 2021.

Check out our latest blog post for more info and ideas:

Thursday, March 12, 2020

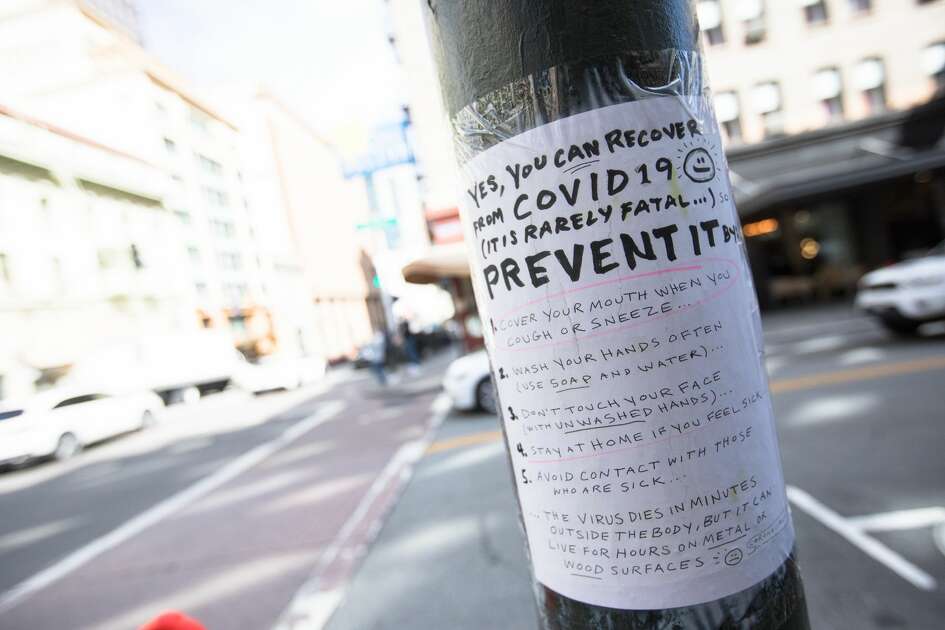

How can you tell if you have a cold, the flu, or coronavirus?

For more coverage, visit our complete coronavirus section here.

If you're showing signs of illness — a cough, runny nose and fever — how do you know whether you have a cold, the flu or COVID-19, the new coronavirus that originated in China and is spreading around globe.

The answer is that it's difficult to tell for sure unless you have been tested by a medical professional.

"It’s really hard because in all those things the spectrum of disease is broad," said Dr. Lee Atkinson-McEvoy, a pediatric doctor at UC San Francisco. "Even in coronavirus, they’re seeing people who have milder disease, so just a cough and runny nose, but no fever. Some people who test positive are asymptomatic, meaning no symptoms at all."

How can you tell if you have a cold, the flu, or coronavirus? Local experts weigh in

If you're showing signs of illness — a cough, runny nose and fever — how do you know whether you have a cold, the flu or COVID-19, the new coronavirus that originated in China and is spreading around globe.

The answer is that it's difficult to tell for sure unless you have been tested by a medical professional.

"It’s really hard because in all those things the spectrum of disease is broad," said Dr. Lee Atkinson-McEvoy, a pediatric doctor at UC San Francisco. "Even in coronavirus, they’re seeing people who have milder disease, so just a cough and runny nose, but no fever. Some people who test positive are asymptomatic, meaning no symptoms at all."

ALSO: Are the elderly at a greater risk for coronavirus complications?

COVID-19 is the most recently discovered coronavirus and was unknown before the outbreak began in Wuhan, China in December 2019. To date, a vaccination or antiviral medication isn't available to treat it, according to the World Health Organization. People with serious illness should be hospitalized.

The flu, a.k.a. seasonal influenza, is similar to COVID-19. It also causes respiratory infection and can also lead severe pneumonia.

"The symptoms between common cold viruses, COVID-19, and the flu overlap significantly, at least in the early stages of illness," wrote Chiu. "Death from coronavirus in patients with pneumonia is thought to be a combination of direct damage of the viral infection to the airways (bronchiolitis and/or pneumonia), an abnormal immune response (“cytokine storm”), and secondary bacterial infections. This is similar to the way people die from flu."

The latest estimates based on the reported number of cases and deaths around the world suggest that the death rate from COVID-19 infection is about 2 percent, but this may change as the epidemic progresses. For comparison, SARS had a death rate of about 10 percent and seasonal influenza has a death rate of 0.1%.

That said, Dr. Lee Riley, a UC Berkeley professor and chair of the Division of Infectious Disease and Vaccinology, adds mortality rate is frequently higher at the beginning of epidemics because "we don't know how to deal with them."

"We have vaccines for influenza so this contributes to its lower rate, but if we didn't have the vaccines, the mortality rates for influenza will be higher than 0.1%," said Riley. "Also, mortality rates for influenza varies according to the virus strain causing the epidemic, which changes every year. So, it's too simplistic to compare mortality rates of two very different types of virus infections."

The most common symptoms of coronavirus are cough, fever and shortness of breath. In some cases, the virus causes severe respiratory illness. If a person develops symptoms and has reason to believe they may have coronavirus, the California Department of Public Health recommends you call your health care provider before going into a clinic or hospital

"Contacting them in advance will make sure that people can get the care they need without putting others at risk," according to the health department. "Please be sure to tell your health care provider about your travel history."

My thoughts

There are so many illnesses going around this year with the Coronavirus at the top of the list. Are you really prepared?

Tuesday, March 10, 2020

Here’s why you shouldn’t celebrate that big tax refund by Darla Mercado @darla_mercado

Filers have reasons to celebrate their small windfall. Most have ambitious plans for their small windfall, including shoring up their savings and paying off debt.

Here’s the downside of getting a large check from the IRS: It means you voluntarily overpaid the taxman last year.

“Most people are really happy about the refund because it’s money going back to them,” said Sean Stein Smith, CPA and member of the American Institute of CPAs’ financial literacy commission.

“But any refund you’re getting back is because you had too much tax withheld from your paycheck during the whole year,” he said.

Where’s the refund coming from?

Whether you owe Uncle Sam or get money back in the spring will depend on a document your employer has on file, known as a Form W-4 or an employee’s withholding certificate.Employers use this form along with the tax withholding tables to figure out how much income tax to pull from your paycheck.

The W-4 considers the number of dependents you have in your household, your filing status, income you generate and whether you’re claiming the standard or itemized deductions on your tax return.

Arriving at the ideal level of income tax withholding is as much art as it is science.

If you withhold far too little, you take home more money with each paycheck, but you run the risk of owing the IRS the following year.

If you withhold too much, you’re giving Uncle Sam more money than necessary. This gives you good odds for a large refund in the spring, but a smaller paycheck in the meantime.

It’s also worth noting that after the Tax Cuts and Jobs Act took effect in 2018, the IRS overhauled Form W-4 and its withholding calculator to reflect major changes to the tax code. These changes include the roughly doubled standard deduction, the elimination of personal exemptions and new curbs on itemized deductions.

You’re supposed to pay quarterly estimated taxes on this income — a requirement that moonlighting “9-to-5ers” may actually overlook.

“There is an extra line on W-4 where you can enter a flat amount that you want withheld form your paycheck,” said Andrea Coombes, tax specialist at NerdWallet. “That can help you get some of those estimated taxes paid and avoid a tax bill next year.”

How to figure out your taxes

If anything, large refunds mean you’ve overpaid taxes.

However, if you really want to see how your taxes stand from one year to the next, look at line 16 of the Form 1040 — your income tax return for 2019 (line 15 on 2018′s 1040). This reports your total taxes paid.

Don’t forget to factor in the amount of income you’ve earned that year, too.

Review your 2019 tax return with your CPA or your tax preparer, as those results can help you strategize for next year.

Steps to consider might include lowering taxable income in the future by raising 401(k) plan contributions or socking money into health savings accounts and flexible spending accounts at work.

Aiming for zero

The IRS’s withholding calculator can help you tailor your tax withholding so that you’re close to matching your federal liability.

The amount of taxes you pay to your state might be a different story, so talk to your tax professional to make sure you’re paying just the right amount.

“In an ideal world, your income taxes withheld from paychecks should cover your income tax liability for that year,” said Smith. “Ideally your refund or additional taxes owed should be zero or as close to zero as possible.”

Tuesday, August 28, 2018

Reduce Refinancing Costs

There is much more than a lower rate and payment to determine whether to refinance a mortgage. Lenders try to make refinancing as attractive as possible by rolling the closing costs into the new mortgage so there isn't any out of pocket cash required.

The closing costs associated with a new loan could add several thousand dollars to your mortgage balance. The following suggestions may help you to reduce the expense to refinance.

· Tell the lender up-front that you want to have the loan quoted with minimal closing costs.

· Check with your existing lender to see if the rate and closing costs might be cheaper.

· Shop around with other lenders and compare rate and closing costs.

· If you're refinancing an FHA or VA loan, consider the streamline refinance.

· Credit unions may have lower closing costs because they are generally loaning deposits and their cost of funds is less.

· Reducing the loan-to-value so mortgage insurance is not required will reduce expenses and lower the payment.

· Ask if the lender can use an AVM, automated valuation model, instead of an appraisal.

· You may not need a new survey if no changes have been made.

· There may be a discount on the mortgagee's title policy available on a refinance.

· Points on refinancing, unlike a purchase, are ratably deductible over the life of the loan ($3,000 in points on a 30-year loan would result in a $100 tax deduction each year.)

· Consider a 15-year loan. If you can afford the higher payments, you can expect a lower interest rate than a 30-year loan and obviously, it will build equity faster and pay off in half the time.

A lender must provide you a list of the fees involved with making the loan within 3 days of making a loan application in the form of a Loan Estimate and a Closing Disclosure Form. Every dollar counts, and they belong to you.Tuesday, August 21, 2018

Moisture & Mold

Moisture is mold's best friend and it thrives between 40 and 100 degrees Fahrenheit which is why it is commonly found in homes. Mold spores float in the air and can grow on virtually any substance with moisture including tile, wood, drywall, paper, carpet, and food.

Moisture control and eliminating water problems are key to preventing mold. Common sources of moisture can be roof leaks, indoor plumbing leaks, outdoor drainage problems, damp basements or crawl spaces, steam from bathrooms or kitchen, condensation on cool surfaces, humidifiers, wet clothes drying inside, or improper ventilation of heating and cooking appliances.

- Control the moisture problem

- Scrub mold off hard surfaces using soap and water or other cleanser; dry completely

- Do not paint or caulk moldy surfaces

- Discard porous materials with extensive mold growth

- Avoid exposing yourself or others to mold

- Periodically, inspect the area for signs of moisture and new mold growth

The EPA suggests that if the moldy area is less than ten square feet, you can probably handle the cleanup yourself. If the affected area is larger than that, find a contractor or professional service provider.

Increasing ventilation in a bathroom by running a fan for at least 30 minutes or opening a window can help remove moisture and control mold growth. After showering, squeegee the walls and doors. Wipe wet areas with dry towels. Cleaning more frequently will also prevent mold from recurring or keep it to a minimum.

A simple solution to clean most mold is a 1:8 bleach/water mixture. Since homes have thermostatically controlled temperatures and water is used all day long in the kitchen and bathrooms, the environment is conducive to mold.

See Ten things you should know about mold written by the EPA.